Understanding your financial health is crucial, and two key tools can help: credit reports and credit scores. While they are related, they serve different purposes. Your credit report provides a detailed history of your credit activities, including accounts, balances, and payment history. On the other hand, your credit score is a numerical summary, typically ranging from 300 to 850, that lenders use to assess your credit risk.

A healthy credit score can open doors to better loan terms and lower interest rates. Scores are categorized into ranges, with higher numbers indicating better credit behavior. For instance, a score of 750 or above is often considered excellent. Lenders use both your credit report and score to evaluate your applications, making it essential to monitor and understand both.

You can access your credit report for free through annualcreditreport.com. Checking it regularly helps you spot errors and manage your financial health effectively. In the following sections, we’ll dive deeper into how these tools work, how to improve your score, and why they matter for your financial future.

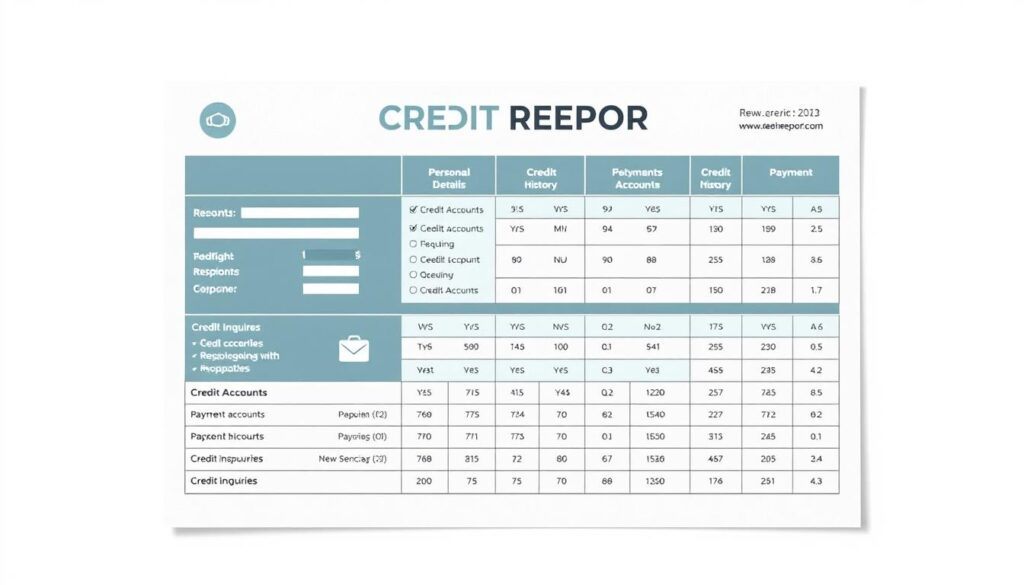

Understanding Your Credit Report

Your credit report is a detailed document that outlines your financial history. It includes personal information, credit accounts, public records, and recent inquiries. This information is collected by major credit bureaus like Equifax, Experian, and TransUnion.

Overview of Credit Report Components

Here’s a breakdown of what’s included:

- Personal Information: Your name, address, and employment history.

- Credit Accounts: Details on credit cards, loans, and other debts.

- Public Records: Bankruptcies, foreclosures, or tax liens.

- Recent Inquiries: List of lenders who’ve reviewed your credit.

Why Your Credit Report Matters

Maintaining an accurate credit history is vital for securing favorable credit card offers and loans. Lenders use the detailed information in your report to assess your creditworthiness. For example, they look at your payment history and account balances to determine risk levels.

Reviewing your report regularly can help you spot errors or signs of fraud. Understanding every section is crucial for long-term financial planning. Your report is a core tool in managing your overall credit information effectively.

How to Access Your Credit Information

Staying informed about your financial health is essential, and accessing your credit information is a key part of that process. Whether you’re applying for a loan or just want to keep track of your financial standing, knowing how to obtain your credit report and score is crucial.

Free Credit Report Options

You can get a free copy of your credit report once a year from each of the three major credit bureaus—Equifax, Experian, and TransUnion—through annualcreditreport.com. This is the only authorized source for these free reports, ensuring you avoid potential scams. Your report includes details on your payment history, accounts, and any public records.

Methods for Checking Your Credit Score

While credit reports are free, credit scores may require a fee. However, many credit card issuers and banks now offer free scores to their customers. You can also purchase your score directly from the credit bureaus or through services like FICO. Remember, a higher score can lead to better loan terms and lower interest rates.

Regularly checking your credit information helps you spot errors and manage your financial health effectively. By monitoring your payment history and understanding the difference between reports and scores, you can make informed decisions to improve your financial standing.

Credit Reports Vs. Credit Scores: What’s The Difference?

Understanding the distinction between credit reports and credit scores is key to managing your financial health. While they are related, they serve different purposes in assessing your creditworthiness.

Key Definitions and Distinctions

A credit report is a detailed document that outlines your financial history, including personal information, credit accounts, public records, and inquiries. It’s compiled by credit bureaus like Equifax, Experian, and TransUnion. On the other hand, a credit score is a numerical summary, typically ranging from 300 to 850, that lenders use to assess your credit risk.

How Lenders Use Each Tool

Lenders rely on both your credit report and credit score to evaluate applications. Your credit report provides a comprehensive view of your financial behavior, while your credit score offers a quick snapshot. For example, a higher score can lead to better loan terms and lower interest rates.

- Credit Reports: Detail your payment history, account balances, and public records.

- Credit Scores: Summarize your creditworthiness into a numerical value.

Understanding these tools helps you make informed decisions to improve your financial standing and maintain a healthy credit profile.

Key Factors That Impact Your Credit Score

Your credit score is influenced by several key factors, each playing a role in determining your overall financial health. Understanding these factors can help you make informed decisions to improve your score.

Payment History and Debt Levels

Payment history is the most significant factor in calculating your credit score. Consistent on-time payments positively influence your score, while late payments can lower it. Debt levels also matter; keeping your credit utilization ratio low shows lenders you manage debt responsibly.

Length and Mix of Credit History

A longer credit history generally improves your score, as it demonstrates stability. A diversified mix of credit types, such as credit cards and loans, also contributes positively to your score.

Recent Inquiries and Account Activity

Hard inquiries, which occur when applying for credit, can temporarily lower your score. Managing account activity wisely is crucial to maintaining a healthy credit profile.

| Factor | Impact | Details |

|---|---|---|

| Payment History | High | On-time payments boost your score. |

| Debt Levels | High | Lower utilization ratios are better. |

| Length of Credit | Medium | Longer histories are favorable. |

| Credit Mix | Medium | Diversified credit types help. |

| Recent Inquiries | Low | Too many can harm your score. |

Understanding these factors empowers you to take proactive steps toward improving your financial standing and maintaining a strong credit score.

Tips for Maintaining a Healthy Credit History

Maintaining a healthy credit history is essential for your financial well-being. It not only helps you secure better loan terms but also ensures you have access to credit when you need it most. By following a few simple practices, you can keep your credit in top shape.

Monitoring and Correcting Report Errors

Start by routinely checking your credit accounts and monitoring your reports for any discrepancies. Errors on your report can negatively impact your credit score, so it’s important to address them quickly. If you find an error, contact the credit bureau or the reporting company directly to resolve the issue. Many issues can be fixed within a few weeks, ensuring your record remains accurate.

Building a Positive Financial Record

Consistency is key when it comes to building a strong credit history. Commit to good financial practices over the course of a year, focusing on timely payments and responsible credit use. Set up alerts for credit changes and schedule periodic reviews of your report. These habits will help you maintain a positive financial record and improve your credit score over time.

Remember, small missteps, like missing a payment or opening too many credit accounts, can have a big impact on your overall record. By staying vigilant and proactive, you can avoid common pitfalls and keep your credit in great condition.

Common Mistakes to Avoid When Monitoring Credit

Monitoring your credit is a crucial part of maintaining financial health, but several common mistakes can undermine your efforts. Avoiding these pitfalls ensures you keep your credit profile strong and accurate.

Overlooking Crucial Report Details

One of the most frequent errors is ignoring minor inaccuracies in your credit report. Even small mistakes, such as incorrect addresses or outdated account information, can lead to larger issues over time. Misinterpreting the type and significance of credit information can result in poor financial decisions. For instance, closed accounts reported as open or incorrect account balances can affect your score and credibility with lenders.

- Take the necessary time to review every section of your report.

- Address discrepancies promptly to prevent long-term damage.

Falling for “Quick Fix” Credit Score Solutions

Many individuals fall prey to services promising rapid credit score improvements. These “quick fixes” often provide temporary or superficial results, failing to address underlying issues. While it might be tempting to see quick results, sustainable credit health requires patience and consistent effort.

- Be wary of services offering unrealistic score boosts.

- Verify the credibility of any creditor or service claiming fast improvements.

By avoiding these common mistakes, you can effectively monitor your credit and maintain a strong financial foundation. Remember, time and diligence are key to achieving and preserving a healthy credit profile.

Conclusion

Understanding how your financial habits shape your creditworthiness is key to making informed decisions. Your credit record serves as a detailed history, while your credit score provides a quick snapshot of your financial health. Both tools are essential for lenders to assess your readiness for new accounts and loans.

A strong credit record can significantly impact the interest rates you receive. Even a small improvement in your score can lead to more favorable terms from lenders. By maintaining a healthy mix of credit types and keeping debt levels low, you can build a positive financial profile over time.

Regular monitoring is crucial for catching errors and managing your credit effectively. Take proactive steps to review your report regularly and address any discrepancies. Remember, a higher digit number in your score can open doors to better financial opportunities.

Don’t wait—check your credit information today and start building a stronger financial future. A solid credit record not only enhances your creditworthiness but also gives you peace of mind. Empower yourself with knowledge and take control of your financial health.

FAQ

How can I access my free credit report?

You can access your free credit report annually from each of the three major credit bureaus—Experian, Equifax, and TransUnion—through the official website AnnualCreditReport.com. This service provides a comprehensive overview of your credit history and account information.

What factors impact my credit score the most?

Your payment history and debt levels are the most significant factors. Timely payments and maintaining low balances on your credit cards can positively influence your score. Other factors include the length of your credit history, the mix of credit types, and recent inquiries.

How often should I check my credit score?

It’s a good idea to check your credit score regularly, ideally every few months. Monitoring your score helps you track progress, identify errors, and detect potential fraud. Many credit card companies and financial services offer free score checks.

Can I improve my credit score quickly?

While some changes can impact your score faster than others, significant improvements take time. Paying down debt, correcting errors on your report, and avoiding new inquiries can help. However, there are no overnight fixes—consistent financial habits are key.

What is a good credit score range?

A good credit score typically ranges from 670 to 739 on the FICO scoring model. Scores above 740 are considered excellent. Maintaining a score in these ranges can help you qualify for better loan terms and lower interest rates.

How do lenders use my credit information?

Lenders use your credit report and score to assess your creditworthiness. They evaluate your payment history, debt levels, and the length of your credit history to determine the risk of lending to you. This information helps them decide loan approvals and interest rates.

Can I dispute errors on my credit report?

Yes, you can dispute errors on your credit report. Contact the credit bureau directly to file a dispute. Provide documentation to support your claim, and they will investigate and correct any inaccuracies. This process is free and can help improve your credit score.

How long does negative information stay on my report?

Most negative information, such as late payments or collections, remains on your credit report for up to seven years. Bankruptcies can stay on your report for ten years. However, the impact of these items lessens over time if you maintain good financial habits.

Is it better to pay off debt or build an emergency fund first?

It’s important to balance both. Paying off high-interest debt can improve your credit score and reduce financial stress. At the same time, building an emergency fund ensures you can cover unexpected expenses without going into further debt.

How does applying for new credit affect my score?

Applying for new credit can result in a hard inquiry, which may temporarily lower your score. However, the impact is usually small and short-term. Space out credit applications if you’re planning to apply for multiple lines of credit or loans.